Car depreciation calculator tax deduction

Edmunds True Cost to Own TCO takes depreciation. Our calculator has recently been updated to include both the latest Federal Tax.

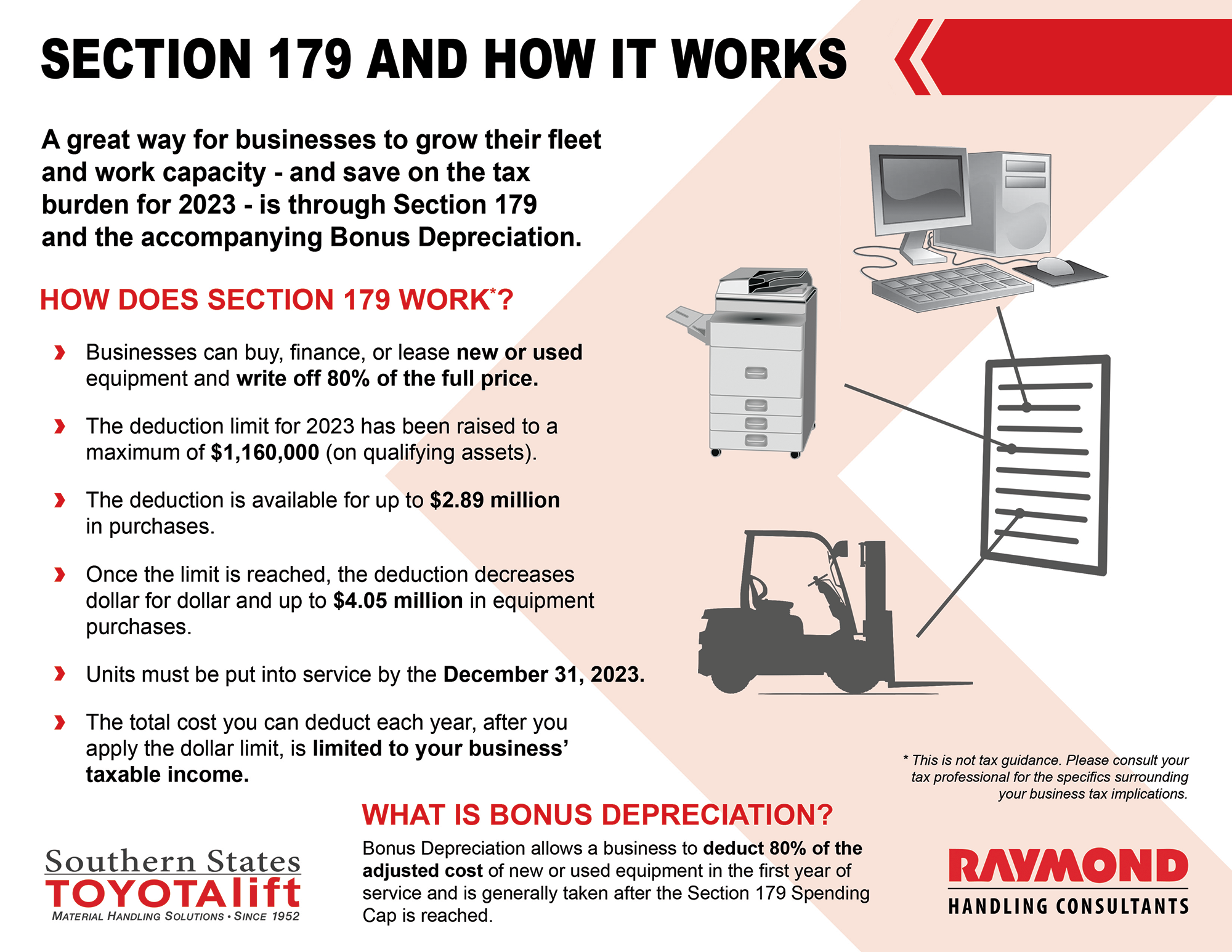

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

D P - A.

. Reduced deductibility of state and local tax credits. It is a fixed amount that can be claimed each year on all applicable building structures for up to forty years. She also worked as a paralegal in the areas of tax law bankruptcy and family law from 1996 to 2010.

It applies to vehicles that are less than 5 years old and the policyholder can avail of it. The other two ways are more logarithmic which could help small business owners by allowing for a larger car tax deduction earlier. But whether or not you bought it for work there are certain other costs you can deduct like the sales tax you paid on it.

In 2021 this is 18200 if the asset was placed into service during the year. Engaging with a tax agent or financial advisor will help you with determining what the best strategy is for claiming a tax deduction for buying a car for business purposes. See State or local tax credit later.

Loan interest taxes fees fuel maintenance and repairs into. NW IR-6526 Washington DC 20224. Find out how to optimise the Travel Allowance section on your Tax Return for the Maximum Tax Deduction.

BMT Tax Depreciation Calculator. Calculate the cost of owning a car new or used vehicle over the next 5 years. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

If you make a payment or transfer property to or for the use of a qualified organization and you receive or expect to receive a state or local tax credit or a state or local tax deduction in return your charitable contribution deduction may be reduced. Each method has its advantages and disadvantages and they often produce vastly different results. Email_capture Deducting car sales tax.

Washington Salary Tax Calculator for the Tax Year 202223 You are able to use our Washington State Tax Calculator to calculate your total tax costs in the tax year 202223. Our calculator has recently been updated to include both the latest Federal Tax. New Jersey Salary Tax Calculator for the Tax Year 202223 You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202223.

It can be used for the 201314 to 202122 income years. Deduct car depreciation. Travel Deduction Tax Calculator for 2022.

The IRS offers two ways of calculating the cost of using your vehicle in your business. FAQ Blog Calculators Students Logbook Contact LOGIN. Sinks and toilet bowls.

This is known as the State And Local Tax SALT deduction which also allows for real estate taxes property taxes and other sales taxes write offs. The first is the actual expense method which uses straight-line depreciation. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Scholars at the Stanford University School of Medicine performed a study in which they investigated the rate at which the interior temperature of a parked car increased during sunny days of temperatures between 72 and 96 degrees Fahrenheit. The Actual Expenses method or 2. If the special allowance does not apply the limit is 10200.

The capital works deduction relates to the building structure and assets permanently fixed to the building. Must contain at least 4 different symbols. Beverly Bird has been a writer and editor for 30 years covering tax breaks tax preparation and tax law.

For cars specifically the Section 179 limit is 10100 18100 with bonus depreciation. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or Oregon. Sinks basins baths and toilet bowls.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. Weve partnered with Naked to help you get your car covered against theft accidents and Mother Nature. 6 to 30 characters long.

A P 1 - R100 n. Available online or as an app for iPhone iPad and Android phone or tablets for use anytime anywhere the BMT Tax Depreciation Calculator is an indispensable tool for anyone involved in property investing. Our tool is renowned for its accuracy and provides usable figures and a genuine insight into the potential cash returns you could expect from an investment property.

You can only take this depreciation deduction if you use your car for business. Beverly has written and edited hundreds of articles for finance and legal sites like GOBankingRates PocketSense LegalZoom and more. Ushered in with the Tax Cuts and Jobs Act bonus depreciation makes it possible to claim 100 of the cost of any machinery and equipment purchased.

ASCII characters only characters found on a standard US keyboard. Tax depreciation is a tax deduction claimed for the natural wear and tear of an income-producing building and its assets over time. Zero Depreciation Car Insurance.

This car depreciation calculator shows your car depreciation schedule year by year including Beginning Book Value Depreciation Percent Depreciation Amount Accumulated Depreciation Amount and Ending Book Value. BMT Tax Depreciation Calculator. Bricks and mortar.

This calculator will check your eligibility to claim a deduction and helps you to estimate the deduction you can claim for work-related self-education expenses. The Car Depreciation Calculator uses the following formulae. Their findings demonstrated that the temperature inside a car can increase by 40 degrees Fahrenheit on average over the course.

Zero depreciation cover is also known as bumper to bumper or nil depreciation cover. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Before you use this calculator.

Information you need for this calculator. The special depreciation allowance has not and will not be claimed on the car The special depreciation allowance is part of the 179 deduction which is a limit on the amount you can claim. With zero depreciation coverage the insured does not have to pay the depreciation value of the damaged or replaced parts and the policyholder can claim the full amount.

Each year youll want to calculate your expenses both ways and then choose the method that yields the larger. The average car depreciation rate is 14. If youre looking for assistance on buying a company car or claiming a tax deduction for an already existing car Box Advisory Services can guide you in the right direction.

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. When it comes to expense the asset it provides you with the deduction in the current tax year and by doing so. We welcome your comments about this publication and suggestions for future editions.

With the consideration of the standard tax deduction your calculation would look like. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. There are three ways for small business owners to calculate car depreciation deductions.

Unfortunately the same auto limits that apply to Section 179 also apply to bonus the max deduction is. It is generally the second biggest tax deduction for property investors after interest.

Free Macrs Depreciation Calculator For Excel

Pin On Mission Organization

Section 179 Deduction Hondru Ford Of Manheim

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

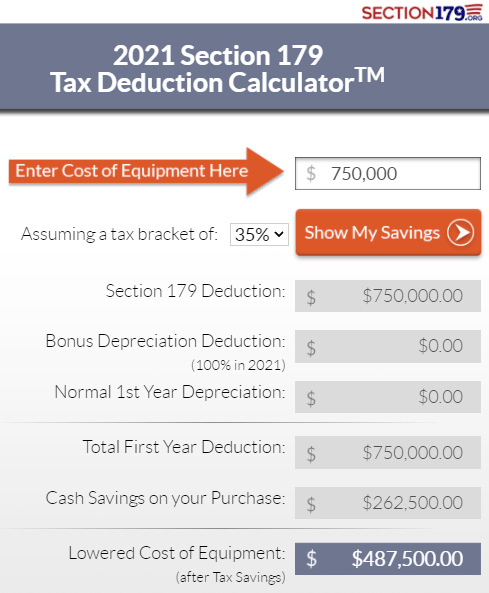

The Current State Of The Section 179 Tax Deduction

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

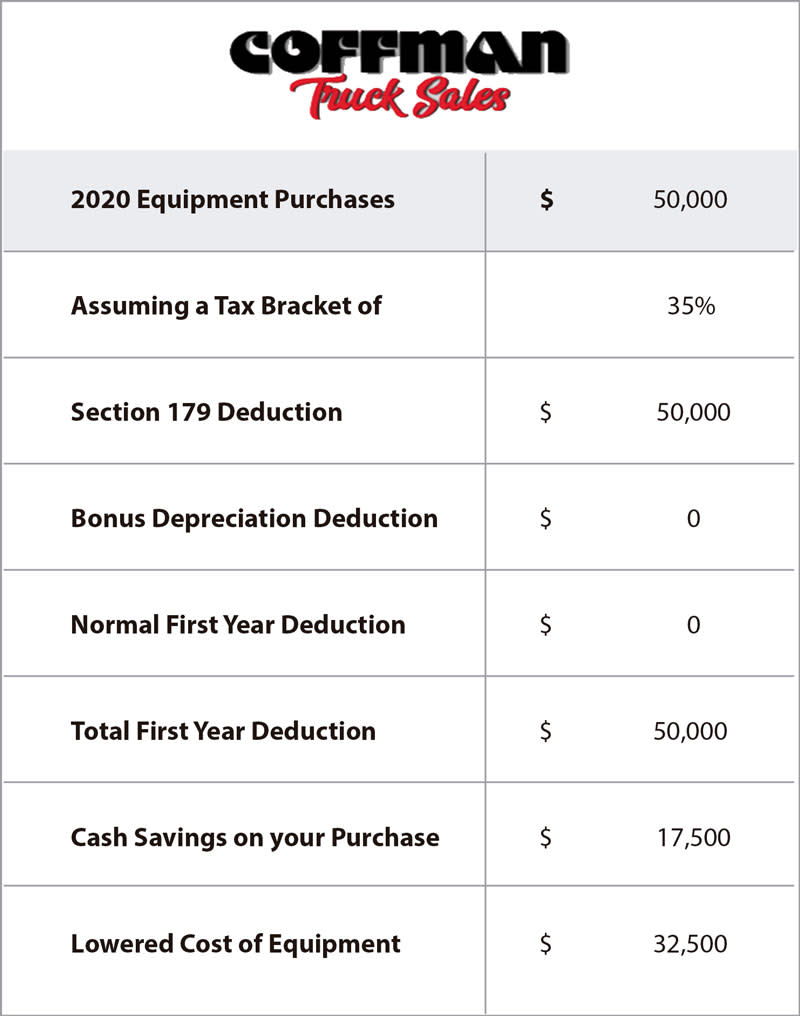

Section 179 Tax Deduction Coffman Truck Sales

Real Estate Lead Tracking Spreadsheet

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax